Mutual Fund

About Mutual Fund

To many people, Mutual Funds can seem complicated or intimidating. We are going to try and simplify it for you at its very basic lever. Essentially, the money pooled in by a large number of investor (or people) is what makes up Mutual Fund. This fund is managed by a professional fund manager.

It is a trust that collects money from a number of investors who share a common investment objective. Then, it invests the money in equities, bonds, money market instruments and/or other securities. Each investor owns units, which represent a portion of the holdings of the fund. The income/gains generated from this collective investment is distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s “Net Asset Value or NAV. Simply put, a Mutual Fund is one of the most viable investment options for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

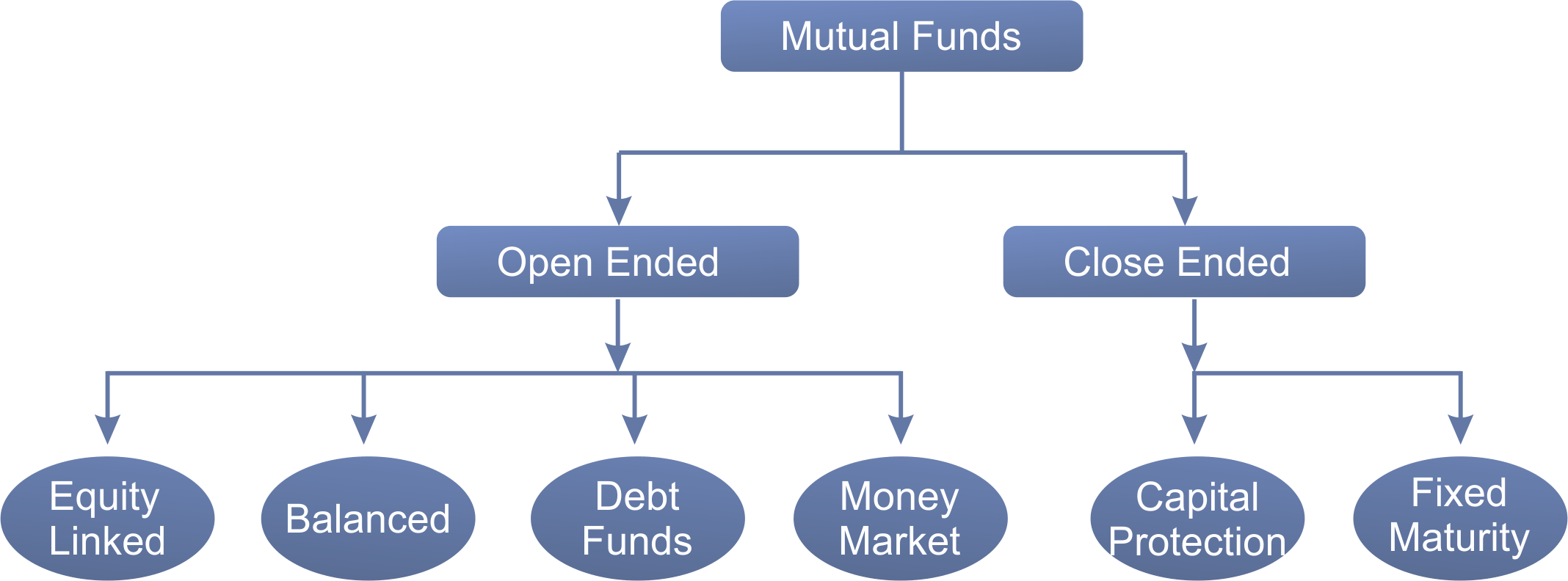

Types of Mutual Funds:

Mutual Funds provide immense opportunities for any type of investor. Based on risk appetite, you can choose the type of mutual fund you want to invest. If you are a high risk taker, you can invest more proportion of your money in equity related funds and if you are more interested in having a regular income with capital preservation, you can opt for debt related mutual funds. Mutual funds offer a one stop solution for all your varied needs. Let us understand the different types of mutual funds in this article.

Equity Funds

Mutual funds gather money from a lot of investors and create a corpus which gets invested in different companies and profitable opportunities.

Equity mutual funds are those mutual funds that invest most of their corpus in the equity shares of companies. The equity scheme invests according to its investment mandate – meaning that “Large Cap” schemes will not invest in Small Cap companies, “thematic” equity schemes will invest in equities around a certain theme, etc. Equity funds can be growth or value-based, and this basis decides the way the stocks are picked.

After allocating the majority of the corpus proportionally between companies as per the investment mandate, equity mutual fund schemes allocate the remaining bit if the corpus towards debt securities and money market instruments in order to keep the fund liquid enough to meet withdrawal requests of investors.

Equity mutual funds are considered to be riskier than other types of mutual funds because the majority of the corpus is invested in equities that could rise or fall with little to no prior warning. While the risk is certainly higher, so is the potential reward (profits). A well-researched and well-managed equity scheme is the ideal investment – as it implies that calculated risks are being undertaken by those that understand the working of the market.

Balanced Funds

A balanced fund combines equity stock component, a bond component and sometimes a money market component in a single portfolio. Generally, these hybrid funds stick to a relatively fixed mix of stocks and bonds that reflects either a moderate, or higher equity, component, or conservative, or higher fixed-income, component orientation.

These funds invest in a mix of equities and debt, giving the investor the best of both worlds. Balanced funds gain from a healthy dose of equities but the debt portion fortifies them against any downturn.

Balanced funds are suitable for a medium-term horizon and are ideal for investors who are looking for a mixture of safety, income and modest capital appreciation. The amounts this type of mutual fund invests into each asset class usually must remain within a set minimum and maximum.

Although they are in the “asset allocation” family, balanced fund portfolios do not materially change their asset mix. This is unlike life-cycle, target-date and actively managed asset-allocation funds, which make changes in response to an investor’s changing risk-return appetite and age or overall investment market conditions.

Debt Funds

Mutual funds investment gathers money from a lot of investors and creates a corpus. The corpus (i.e. the pool of money) is then divided for investment into different companies and income generating opportunities.

While there is no guarantee that any mutual fund scheme will achieve its goals due to the factors of risk and ever-fluctuating markets, debt mutual funds strive to minimise risk by picking the least risky types of investment instruments.

Debt mutual funds invest the majority of their corpus in fixed-income or fixed-interest generating opportunities and instruments. Some examples of the instruments debt funds invest in are – money market instruments, corporate bonds, treasury bills, government securities, commercial papers, etc.

By investing primarily in these opportunities, debt mutual funds reduce the risk factor by a huge margin. As a result of this, the mutual fund scheme also reduces its chances to generate exponential returns like those of successful equity fund schemes. It’s a safer option that seeks to generate income better than fixed deposits rather than high returns.

Debt funds are different from equity funds in many ways – the primary of which is the chosen investment instrument or opportunity.

Money Market

Money market mutual funds (MMF) invest in short-term debt instruments, cash, and cash equivalents that are rated high quality. It is for this reason that money market mutual funds are considered safe or investment with minimal to low risk. As these funds invest in high-quality instruments, they offer a predictable risk-free return rate.

Money market mutual funds (MMMF) are used to manage short-term cash needs. These funds are open-ended in the debt fund category and deal only in cash or cash equivalents. Money market securities have an average maturity of one-year; that is why these are termed as money market instruments.

The fund manager invests in high-quality liquid instruments such as treasury bills (T-Bills), repurchase agreements (Repos), commercial papers, and certificates of deposit. Money market funds mainly target earning interest for the unit holders. The primary aim of money market funds is to minimize the fluctuation of the Net Asset Value (NAV) of the fund.

Capital Protection

The main purpose of capital protection funds, which is a classification of a closed-end hybrid fund, is to safeguard the interest of the investors during economic downturns and at the same time offer them some scope for capital appreciation. Given the nature of these funds, they substantially minimize the risk of capital loss with the major chunk of the amount invested in AAA-rated bonds which have only a minimal chance of defaulting.

The portfolio of capital protection funds consists of a mix of equity and debt, where the major investment is towards debt, particularly zero coupon debt, and only a small fraction of the portfolio is dedicated to equity. The maturity of the debt portfolio and the lock-in period of the funds are aligned, which further protects it from volatile interest rate movements. The chances of interest rate fluctuation related market-to-market losses are also averted as these debt instruments are held till the time of maturity. These are close ended funds with a term usually between 1, 3 and 5 years, offering a conservative investment option.

Fixed Maturity

Fixed Monthly Plans (FMPs) are closed-end debt funds having a fixed maturity period. Unlike other open-ended debt funds, FMPs are not available for subscription continuously.

The fund house comes up with a New Fund Offer (NFO) which will have an opening date and a closing date. You can invest in an NFO only when it is available for subscription. After the closing date, the offer to invest ceases to exist.

FMPs usually invest in debt instruments such as certificates of deposit (CDs), money market instruments, corporate bonds, commercial papers (CPs), and bank fixed deposits. The fund manager invests in instruments having similar the desired maturity period.

For example, if FMP is for five years, then the fund manager invests in a corporate bond having a maturity of five years.

Unlike other debt funds, the fund manager of FMP follows a buy and hold strategy. There is no frequent buying and selling of debt securities like other debt funds. This helps to keep the expense ratio of FMPs at lower level vis-a-vis other debt funds.