About Us

Global Portfolio & Financial Services was established in the year of 2009 and is originally based at Vasundhara, Ghaziabad.

We have 10 years of experience, more than 250 clients across Delhi-NCR and from other state.

Global Portfolio & Financial Services aims to be the most useful, reliable and efficient provider of financial services. It is our continuous endeavour to be a trustworthy partner to our clients, helping them protect and grow their wealth, and achieve their life goals.

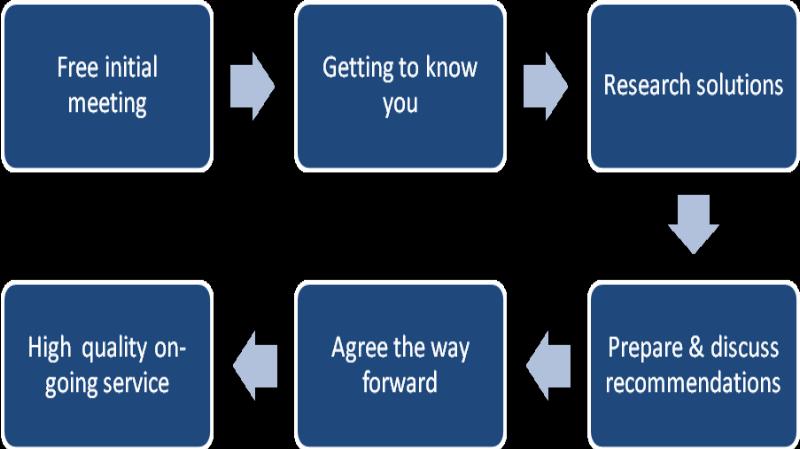

Advice Process

Our Advice Process follows six steps as outlined below

1. Free Initial Meeting

- The first meeting is free where we will discuss your requirements

- This is an opportunity for you to find out more about Global Portfolio & Financial Services and for us to see how we can help you

- At the end of the initial meeting if you are happy to proceed we will discuss our client service proposition and agree how you wish to pay for the advice

- We will then discuss the timescale to prepare our recommendations and arrange the next meeting

2. Getting to Know You

- We will have a more detailed discussion around your current circumstances and record this so we can ensure our advice is tailored to your needs

- This may take place immediately after the initial meeting or at a future meeting

- ‘Getting to know you’ is an on-going process as your circumstances and needs will change over time

- As part of this process, we will complete a personal fact find which will help us to understand your knowledge and experience in financial services. We will also complete a questionnaire to help us understand your attitude to investment risk.

- We will not make any recommendations to you until this part of the process has been completed.

- We may need to ask you to sign a document to authorize Global Portfolio & Financial Services to be the servicing adviser on your existing investments.

3. Research Solutions

We will undertake detailed research taking into account every possible aspect of your financial and personal circumstances including; your tax position, what plans you currently hold and your future needs.

- It may be your adviser will need to contact you again at this stage to clarify or expand on certain pieces of information.

- This process will typically take two weeks but may be shorter for simple cases or considerably longer when we have to obtain information from life offices on your existing plans.

4. Prepare and Discuss Recommendations

- Once the adviser have prepared the recommendations your adviser will review this in detail and tailor the report directly to the discussions you have had.

- You will be given the recommendations in writing in a suitability report along with any illustrations and key features documents.

- We will always attempt to give holistic advice so the suitability report will go beyond any specific product sale that is being recommended.

- You will have time to review the recommendations at a further meeting with your adviser

- It is important to us that you fully understand and are happy with what is being recommended so we encourage you to ask questions and discuss the recommendations in detail with your adviser.

5. Agree the Way Forward

- You may decide you wish to proceed with some or all of the recommendations proposed.

- In rare cases you may decide not to proceed at all, however by working with you at every step of the way we hope this will not be the case

- If you do decide not to go ahead with the recommendation we will charge you a minimum fee of Rs.500 or whatever else was agreed in your initial discussion.

- Once agreed, your adviser will assist you with the preparation of any paperwork that is required and submit it on your behalf

6. High Quality ongoing Advice

- We will keep you informed of the progress of any applications you have submitted

- Once everything is complete you will receive a confirmation letter along with any documents that you need to keep

- You will receive an on-going service based on our agreed service proposition

- Each year we will review your service level and where appropriate adjust it to be commensurate with the recurring fee income we have received.

- If our recurring fee income is less that Rs.2500 per year, your account will be considered to be dormant, and you will not receive a proactive Services.

Technology & Support

- Online Platform, Mobile application to help our clients to make hassle free investments and track their investment online at one place.

- Backend team to help our clients at any point of time whenever you need our support, clients can directly contact for any query or requirements, we are always available with best of our assistance and services.